BRIEF FROM SUSTAINABLE PROSPERITY

This brief will provide Sustainable Prosperity’s (SP) perspective on the 2012 federal budget, based on its analysis of the measures and policies contained in the 2011 federal budget. The analysis and recommendations the brief contains are informed by a number of key assumptions made by Sustainable Prosperity, which are explained below. This brief is an abridged version of a longer submission, which Sustainable Prosperity hopes to present to the Finance Committee when it holds its hearings.

The brief is organized as follows:

1. Background on Sustainable Prosperity

2. Key assumptions underlying the brief

3. Findings on Budget 2011

4. Recommendations for Budget 2012

SP’s three recommendations for Budget 2012 (explained in greater detail below) are:

i. Budget 2012 should introduce the concept of “national capital” as a framework for assessing and explaining national wealth and prosperity

ii. Budget 2012 should contain a specific and structured focus on the green economy.

iii. Budget 2012 should provide greater discussion and explanation on instrument choice.

1. Background on Sustainable Prosperity (SP)

Sustainable Prosperity is an independent research-based organization based at the University of Ottawa. Its mandate is to promote the development of a green economy in Canada, with a particular focus on the role that market-based policies can play in achieving positive economic and environmental outcomes.

Our approach is unique. We believe that achieving the necessary innovation in policy and markets for a stronger, greener, more competitive Canadian economy requires a new knowledge base and new conversations. SP’s approach is to promote both, through the following activities:

· Generating policy-relevant, expert knowledge: synthesize and advance policy-relevant research on market-based approaches to advance environmental protection and economic sustainability, through a national network of academics and experts.

· Fostering innovative conversations and connections: bring together unusual alliances of researchers, decision-makers and policy leaders, across the environment-economy spectrum.

· Informing smart policy solutions: communicate research-based analyses and options for policy initiatives to build a stronger, greener, more competitive economy.

We harness leading-edge thinking to advance innovation in policy and markets, in the pursuit of a greener, more competitive Canadian economy. At the same time, SP actively helps broker real-world solutions by bringing public and private sector decision-makers to the table with expert researchers to both design and apply innovative policies and programs. Our research is currently focused on four themes: the low carbon economy, sustainable communities, ecosystems services and markets, and economy-wide and emerging issues.

2. Key assumptions

Sustainable Prosperity’s analysis of Budget 2011 and recommendations for Budget 2012 are based on the following assumptions:

A. The budget is the federal government’s most important annual policy statement. It reflects in the most direct way possible, through its announcement of federal spending, tax, and regulatory initiatives, the government’s policy priorities for that year. Moreover, through the link it establishes between budget measures and Canada’s economy, it helps explain the relationship between government policy and economic performance. This creates a framework for measuring performance of government policy, and ultimately accountability for policy success.

B. The pursuit of a “green” economy is a strong and abiding national interest, and should constitute an important priority for the federal government. This is because the continued health of Canada’s environment is of direct interest to our social and economic aspirations, but also because international markets - upon which Canada is so dependent for its prosperity - are increasingly demanding products and services that are produced and delivered sustainably.

C. Innovation and productivity are, and should continue to be, important drivers of Canada’s national economic policy. As such, they represent important factors for assessing the budget’s impact both in terms of the “microlevel” impact of specific measures but also of the “macro-level” impact of the overall budget orientation.

D. The pursuit of innovation and productivity should be an integral part of Canada’s environmental policy as much as it is of its economic policy, and conversely the pursuit of environmental sustainability should be an integral part of Canada’s economic policy. Given the importance of natural resources to Canada’s economic prospects, policies which promote a more efficient and productive use of those resources can generate positive economic and environmental outcomes, and so promote the development of a green economy in Canada.

3. Findings on Budget 2011

Our approach to this submission has been to focus our efforts on assessing the government’s overall approach to the development of a green economy in Canada. The definition we have used for a “green economy” has been quite broad, and so should be seen as capturing a fairly large swath of the measures contained in the budget. Our analysis is less concerned, however, with the overall level of support the budget contains, but is more focused on an assessment of the effectiveness, efficiency, and ultimate role of the budget in promoting a green economy in Canada.

Finding #1: The 2011 budget should be seen as a “holding” budget for the green economy, and environmental policy in general. It provides resources for important environmental initiatives, but the major allocations are designated for the continuation of existing programs. It does not contain any major new initiatives. As such, it does not reflect any new or emerging focus on the green economy, or on environmental issues generally, by the government.

Finding #2: The green economy measures contained in the budget are not part of an overall framework or strategy, but are more ad hoc measures meant to address specific needs. Moreover, the budget document provides very little description of objectives or expected outcomes for some of the green economy initiatives (particularly support for regulatory measures).

Without an overall strategy or defined objectives for the various policy measures, it is difficult to judge the impact that these will have on the promotion of innovation, productivity, and sustainability (which, as stated above, SP believes should be key effectiveness criteria for green economy policy). This difficulty extends out into the future, as it will make any post-hoc assessment of the measures’ effectiveness problematic, and so raises question about accountability

Finding #3: There is a heavy reliance in the 2011 budget on spending and regulatory measures, and relatively little on tax measures. Our analysis shows that of the $ 1.96 billion in new budget environmental commitments, only $48 million (or 2.2%) comes in the form of tax measures.[1] Research into policy instrument choice, particularly around environmental policy instruments, suggests that tax measures can provide equivalent levels of policy effectiveness to regulatory instruments with a greater degree of efficiency. In other words, a tax instrument can deliver the same objective at lower cost than a regulatory measure. Moreover, research also shows that tax- or price-based policy instruments provide an ongoing incentive to innovation that regulatory instruments do not.

That is of course, a generalized and theoretical conclusion (although borne by policy experience), and so SP is not suggesting that the regulatory measures found in the budget could be replaced by tax instruments. But the budget document contains no explanation of instrument choice, and so no rationale for why regulatory measures have been chosen over fiscal ones. Without such an explanation, it is difficult to assess the relative effectiveness of the instruments in promoting innovation and productivity.

4. Recommendations for budget 2012

Given Sustainable Prosperity’s basic view of the budget as the government’s primary policy statement, and our assessment of Budget 2011 as a reflection of the government’s priorities in relation to the green economy, we would make the following recommendations for Budget 2012:

1. Budget 2012 should introduce the concept of “national capital” as a framework for assessing national wealth and prosperity.

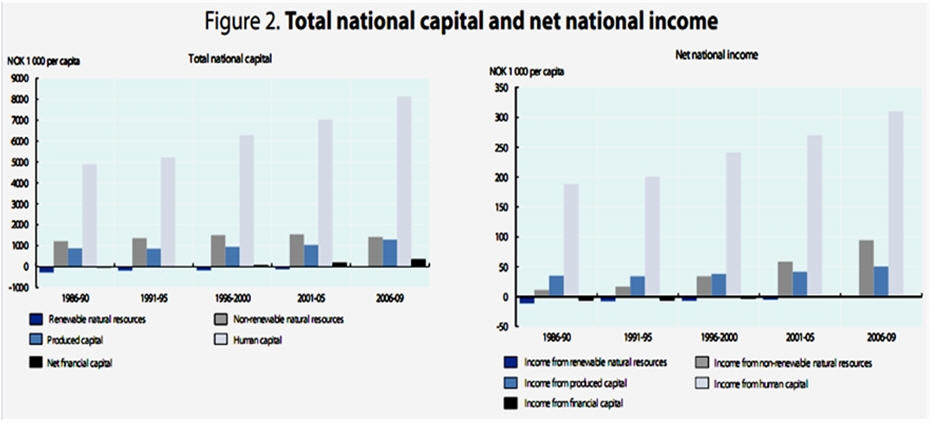

Norway - a country much like Canada - has pioneered a framework though which its economy is broken down into various forms of capital (human, natural, built, financial, etc.). With a commitment to increasing its national capital year-to-year, the breakdown allows policy makers and the general public to understand how various forms of capital rise and fall, and how the overall growth in the national capital helps to ensure the country’s continued (and long-term) prosperity. Given the importance of Norway’s oil industry to its national economy, the framework also creates a clear indication of how its natural capital (i.e. oil and gas) is being converted into other forms of capital and so contributing to the long-term wealth of the country.[2]

Sustainable Prosperity believes that Canada could benefit greatly from the use of such a framework. Canadians would better understand the components of our national wealth, and how each of these contributes to our overall prosperity. The framework, and its use by policy makers in documents like the federal budget, would be a very useful tool in helping to explain how economic, environmental, or social policies relate to the enhancement of our national capital; and so help in increasing confidence in the role of public policy in building prosperity for Canadians now and in the future.

2. Budget 2012 should contain a specific and structured focus on the green economy.

The piece meal and ad hoc approach to environmental commitments in the budget process should be replaced by a more strategic approach to the development of a green economy in Canada, with specific reference to the promotion of sustainability-driven innovation and productivity. This approach would be based on a clear statement of desired policy outcomes and objectives in relation to the green economy, followed by a discussion and explanation of the policy instruments - spending, tax, and regulatory - to be used to achieve these outcomes and objectives. As a concrete example, Budget 2012 should begin to provide - in its overall discussion of Canada’s economic performance (typically found in the first chapter of budget documents) - reporting on Canada’s greenhouse gas emissions (GHGs).

Among many possible benefits of implementing such an approach would be the enhanced ability of Canadians and their elected representatives to understand how the budget is contributing to the achievement of Canada’s GHG emission commitments, and so increase accountability of the government of Canada on this important issue.

3. Budget 2012 should provide greater discussion and explanation on instrument choice.

Sustainable Prosperity believes that, as a general statement, a greater reliance on tax (and market-based) instruments can help Canada achieve policy outcomes at lower cost to the economy than regulatory measures, while promoting greater innovation and productivity.

Understanding the specific choices in policy instruments made by governments - and reflected in budgets -is difficult in the absence of discussion and explanation of the underlying analysis and rationale for the choices that have been made. So, without prejudging the choices made by the government, SP suggests that greater transparency on instrument choice in relation to specific policy objectives would enhance understanding and assessment of the impact of the policy measure.

Appendix A

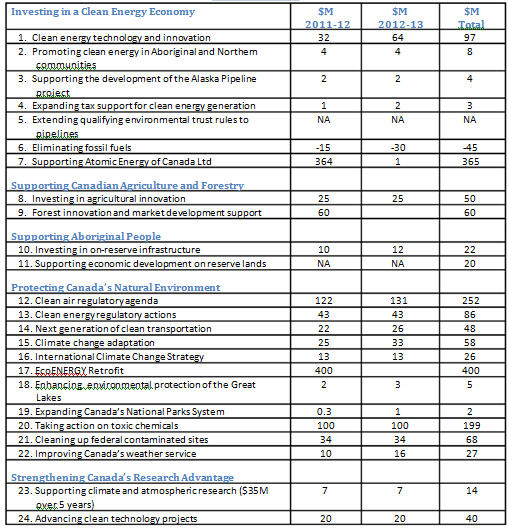

Budget 2011: Green Economy

Budget Measures

Appendix B

[1] A list of these commitments, as assessed by SP, is attached as Appendix A. Again, we consider that the measures included in our assessment of “green economy” measures represent a very broad scope of activities, and caution against attributing to the scale of the included commitments any conclusions on the overall priority given to the green economy in the 2011 budget.

[2] A figure showing how the various forms of capital are broken down and how they have evolved over time is provided as Appendix B.